Opinion Leaders

Opinion Leaders

2016 Review – A Year of Two Halves Part II

-

Dr. Jan-Carl Plagge, Head of Applied Research

Fixed-income and FX markets underwent a big shift in trend in 2016 as political developments promise to change the global economy.

Our first part of a 2016 review on PULSE ONLINE on Jan. 19 examined the performance of equity strategies in what was a truly eventful year.

Fixed-income markets, for their part, also saw a break in the second half of the year of what has been a long-lasting regime of falling yields supported by ample monetary stimulus around the world.

Donald Trump’s reflationary agenda added to an incipient acceleration in growth and consumer prices that helped, as the year drew to a close, shift sentiment about the economic outlook. Investors quickly raised bets that the US and global economies may finally break out of a deflationary trap. Yields on 10-year US Treasurys climbed to 2.59% on Dec. 16 after falling through the first half of the year to a record low of 1.36% in July.

Yields on 10-year German government bunds also rose in the final months of the year after tumbling to negative territory in June.

Monetary Policy

The US Federal Reserve (Fed) in December proceeded with the second interest-rate increase in a decade, while Chair Janet Yellen said the central bank now sees three rate increases in 2017, one more than previously envisaged.

The European Central Bank (ECB), separately, stepped up its intervention. The bank in March cut its key interest rates, increased and expanded its asset purchase program to include corporate bonds, and introduced a new series of cheap loans for banks. President Mario Draghi reiterated that interest rates would remain “at present or lower levels for an extended period of time.”

In spite of central banks’ active buying of bonds, credit suffered the headwind of the sudden rise in yields. The EURO STOXX 50® Corporate Bond Index rose 3.3% excluding coupon payments between Jan. 1 and July 29, only to erase the gains in the second half and finish the year close to where it started it. Income included, the index returned 3.2% in the whole year.

Currencies

Expectations for faster growth and higher rates in the US helped the dollar clinch its third consecutive year of gains vis-à-vis the euro, with most gains also taking place in the second half. The common currency had weak drivers of its own: the ECB dug deeper into its monetary easing toolbox, concern grew about the cohesion of the European Union, and worries lingered about the state of Eurozone banks’ accounts.

The euro fell to 1.039 the dollar in December from 1.086 at the start of the year, with many forecasters saying parity with the dollar is a possibility in the short term.

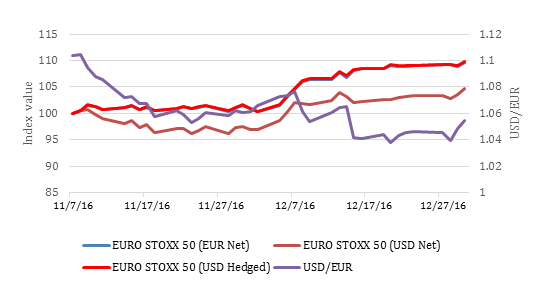

This has consequences for investors outside of the Eurozone. While the EURO STOXX 50 in euros, for example, gained 9.6% between Trump’s election and year-end, an unhedged dollar-based investor would have sacrificed 4.8 percentage points due to the simultaneous devaluation in the European currency. Chart 1 shows the performances since the US election of hedged and unhedged strategies in European equities for investors who report in dollars.

Chart 1

Dollar-based investors that hedged their currency exposure to the euro would have been substantially better off than unhedged investors. In the chart, the lines for the EURO STOXX 50 (EUR Net) and EURO STOXX 50 (USD Hedged) portfolios overlap, proof of the efficiency of a hedged strategy.

British exit plans

It was sterling, however, that fell to the weakest-link rank among the world’s most-traded currencies, after the UK voted to leave the European Union. The pound dropped 16.7% to 1.222 to the dollar in the year. Concerns that Prime Minister Theresa May’s government may have had little concrete plans for a EU exit path worsened the outlook for the British economy.

To counter any slowdown caused by the Brexit uncertainty, the Bank of England in August cut the key interest rate for the first time since 2009, announced new loan facilities and expanded its quantitative easing program.

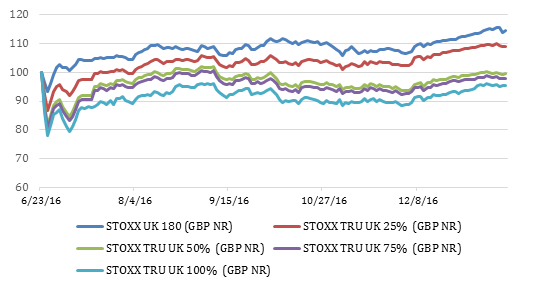

Investors rushed to position portfolios towards companies that stand to benefit from the pound’s tumble, creating in the process one of the biggest market divergences this year. While the STOXX True Exposure™ UK 100% of British companies that rely entirely on domestic sales for their revenues fell 5.3% between June 23 and Dec. 30, the broader STOXX® UK 180 Index (which includes large, multi-national companies) gained nearly 14% (see chart 2). In fact, performance of UK equity indices since the referendum could be modeled as a function of companies’ revenue exposures to the UK. For more on this performance and the True Exposure indices, please click here.

Chart 2

Outlook for 2017

As a new year starts, investors are likely to face further volatility as a new administration takes office in the US, the Fed continues to raise interest rates and several key European nations are poised for general elections.

PULSE ONLINE will publish in coming days its annual outlook for financial markets for the next 12 months.