Opinion Leaders

Opinion Leaders

Giant Indonesia Gets Investor Endorsement

-

Shirley Low-Storchenegger, Head of Asia/Pacific

The world’s fourth-most populous economy is on the upside – and the stock market has been following suit.

The upgrade of Indonesia’s rating credit to investment grade by Standard & Poor’s on May 19 didn’t pass unnoticed. The Jakarta Stock Exchange Composite Index (JCI) jumped 2.6% to a record on the news. Expectations are for overseas money to also flow into Indonesian debt, lowering financing costs for the country’s state and companies.

Investors’ excitement can be understood. The Southeast Asian nation is the world’s fourth-most populous country, with 264 million inhabitants. But it is also expanding at an enviable rate: the International Monetary Fund (IMF) predicted in April that the country will grow at an average 5.2% in 2017 and 2018, with the pace accelerating to 5.5% by 2022. Large population plus rapid growth puts Indonesia potentially in par with economic giants such as India, China and Russia.

S&P Global Ratings cited the stabilization of Indonesia’s public finances as reason for its upgrade. This month the IMF commended the Indonesian authorities for undertaking major reforms since 2010 in the fields of financial supervision and systemic risk management.

The STOXX® Indonesia Total Market Index has risen 5.3%1 in the past three months, compared with a loss of 0.4% for the STOXX® Asia/Pacific 600 Index. Still, the Indonesia index has underperformed the Asia/Pacific benchmark by over 40 percentage points in the last five years.

Commodities, politics may dictate returns

Looking forward, investors have plenty of reasons to be both optimistic as well as more cautious.

Among the latter, some analysts say the 9.1% rally in the JCI year-to-date leaves equities vulnerable to corrections. Commodity prices have also weakened significantly in 2017, adding pressure on materials exporters like Indonesia. Politics may bring about market volatility and accentuate religious friction as the country heads to elections in 2019.

On a positive note, economists cite the lower cost of capital, growing earnings and continued economic reforms as underpinning a more bullish picture.

An efficient vehicle into emerging markets

To combat one of the issues that investors face when investing in emerging markets, STOXX introduced the STOXX® Optimised Indonesia Index, which seeks to safeguard the liquidity of investments in the country.

The Optimised index applies a special weighting factor that downscales stocks that are rather illiquid relative to their market capitalization. This mechanism improves the tradability of a portfolio and lowers turnover costs.

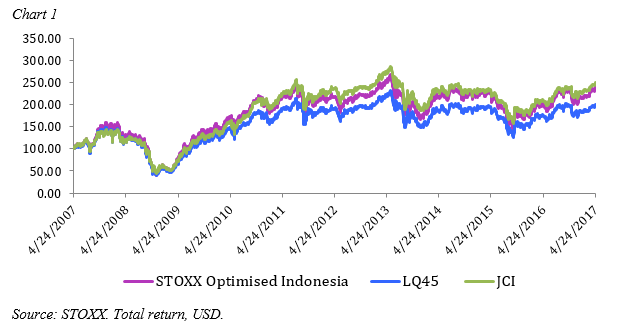

Chart 1 shows the performance of the STOXX Optimised Indonesia Index against the JCI (all stocks) and the LQ45, a benchmark from the Indonesia Stock Exchange that tracks the 45 most liquid companies.

While the Optimised Indonesia Index closely tracked the JCI in the period, it provided a larger margin of liquidity safety, key to investors who may be forced to sell holdings during drawdowns. Both indices significantly outperformed the LQ45.

During a recent investor forum hosted by Bloomberg in Singapore, Indonesia received the most votes (53%) from attendees as the most appealing Southeast Asian market for the asset-management industry.2

Whether investors’ endorsement of Indonesia will continue remains to be seen. For now, those who have joined the market are being rewarded.

Featured Indices

STOXX® Optimised Indonesia Index

STOXX® Indonesia Total Market Index

1 EUR, Net Return.

2 “Indonesia’s fund flows and the future of buy-side technology,” Jakarta Globe, May 25, 2017.