Opinion Leaders

Opinion Leaders

Infrastructure Assets: the US Eyes Upgrade Plan

-

Dr. Jan-Carl Plagge, Head of Applied Research

A STOXX study revisits the benefits of infrastructure investments as the Trump Administration pledges more spending.

A prominent pledge during US President Donald Trump’s campaign was to fix the country’s infrastructure, where years of underinvestment have left many roads, airports and utilities in degradation and unfit for current needs.

Trump last month vowed to ask Congress to pass a 1 trillion-dollar “national rebuilding” program, to be financed through public and private capital. The American Society of Civil Engineers (ASCE) estimated this month that 4.59 trillion dollars will be needed through 2025 to improve and maintain US infrastructure, of which 2.06 trillion remain unfunded1. Consultancy firm McKinsey has forecast that 57 trillion dollars will be needed globally between 2013 and 2030 to finance infrastructure projects just to keep pace with the current economic expansion.2

There’s vested interest from governments in repairing infrastructure. According to UBS, every 40 billion dollars in government spending adds 0.2-0.3 percentage points to GDP3. Bipartisan disagreement in Congress hindered in recent years the launch of a comprehensive new plan of investments.

While Trump’s announcement has yet to materialize, and large infrastructure projects famously undergo slow approval processes, the debate ball has started to roll. This opens up a historical opportunity for investors, who have in the past benefitted from infrastructure’s stable returns.

A different asset class

Direct investing in dams, highways and sewage systems is not an option for many asset owners such as insurers and pension funds either because of the high capital commitment required or because of the lack of liquidity in those assets.

It is here where listed infrastructure has played a key role in linking financing needs with investors’ search for returns. This month we published a report entitled “Realizing the Promise of Listed Infrastructure Investments” – accessible here – that highlights the advantages of the asset class.

Listed vs. unlisted

The benefits of listed infrastructure assets include:

- They can be easily accessed through exchange-traded securities, with the related benefits of tradability and liquidity.

- Listed index products can provide greater diversification: the purchase of just one exchange-traded fund can give exposure to over 150 distinct projects, covering different geographies and economic segments.

- Easier due diligence: more transparency in portfolio composition than when investing in specialized funds, and better stock-level financial disclosure.

- Lower capital requirements than a direct investment and lower management costs than specialized funds.

Stable businesses with protected markets

In turning now to the characteristics of infrastructure assets, a key feature is that they tend to be stable cash-flow generators with strong commercial models often protected by quasi-monopolistic barriers to entry and inelastic consumer demand. This is not to say there are not specific risks – mainly regulatory and political.

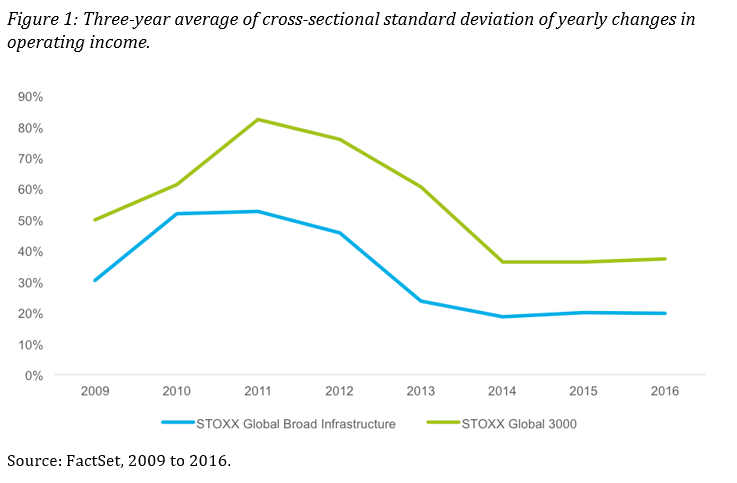

The result is an asset class with typically low business and macroeconomic or systematic risk. Figure 1 compares the variability of annual changes in operating income for the STOXX® Global Broad Infrastructure Index relative to the STOXX® Global 3000 Index. This average variability in recent years was about 22 percentage points lower for infrastructure companies.

Lower volatility, higher dividends

The lower business risk has translated into more stable share prices for infrastucture securities in equity markets. Over the last nine years, the STOXX infrastructure index has posted an annualized volatility of 15%, compared to the market’s 17.6%.

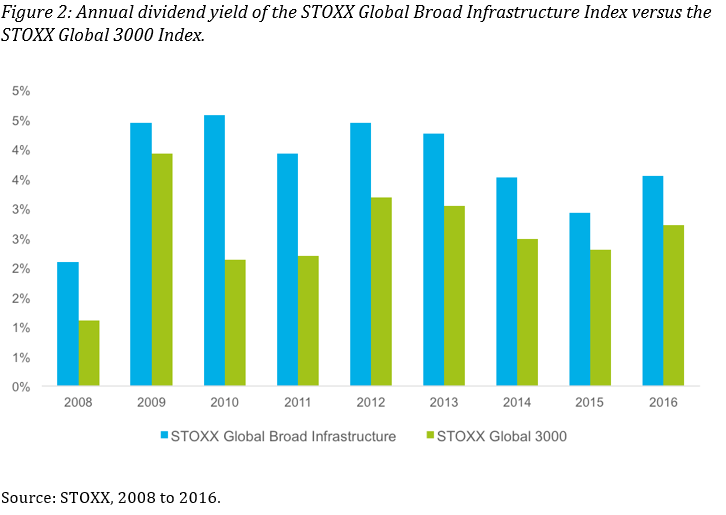

But infrastructure companies also have high operating leverage, which can result in significant free cash flow when unit volumes increase. Operating leverage combined with low business risk allows infrastructure companies to support comparatively high dividends, as seen in Figure 2.

Infrastructure companies devote more of their earnings to return money to shareholders than does the average business. In the period analyzed above, the average payout ratio (dividends per share divided by earnings per share) for infrastructure companies was 18.6 percentage points higher than for the rest of companies.

A hybrid asset to offset long-term liabilities, inflation

Reliable and often regulated earnings and high payouts sit well with the mandate of investors with long-term liabilities; and many treat infrastructure assets as long-duration securities similar to bonds. The dominant market position of infrastructure assets has also allowed them to more easily link revenues to inflation, becoming in essence an inflation hedge.

In this sense, listed infrastructure can be considered a hybrid that provides equity-like returns coupled with the income and duration characteristics of fixed-income securities.

Diversification in portfolios

A further point of interest is that infrastructure can provide diversification within portfolios. The average beta to the broad market has been 0.78 over the past nine years. This indicates that infrastructure companies reacted less sensitively to changes in the market (beta of 1), although the investment performance was equivalent.

The STOXX Global Broad Infrastructure Index takes a broad definition that includes all sectors that are vital to the development of the economy. The benchmark of 151 listed companies from developed and emerging nations consists of five infrastructure supersectors and 17 subsectors. The index caps the maximum weight of represented supersectors and countries to avoid concentration.

The index has served as the underlying for the FlexShares STOXX Global Broad Infrastructure Fund, which trades in New York, since 2013.

A global opportunity

While infrastructure is a hot topic in the US right now, the rest of the world is also in pressing need to build and run new assets as economies expand and populations grow. With many insurers and pension funds reportedly still holding limited investments in infrastructure4, the asset class looks set for growth.

By Rod Jones, Head of North America, and Dr. Jan-Carl Plagge, Head of Applied Research, STOXX Ltd.

1 “2017 Infrastructure Report Card,” ASCE, March 9, 2017.

2 “Infrastructure productivity: How to save $1 trillion a year,” McKinsey Global Institute, January 2013.

3 “A new set of rules,” CIO Wealth Management Research, UBS, Jan. 12, 2017.

4 “Pension funds and insurers share appetite for infrastructure,” Pensions Expert, Feb. 3, 2016.