Opinion Leaders

Opinion Leaders

«Innovate2Invest 2017» – The Future of Factor Investing

-

Dr. Jan-Carl Plagge, Head of Applied Research

Aniket Das of LGIM and Dr. Jean-Carl Plagge of STOXX discussed the merits of factor investing targeting returns and diversification.

This is the fifth installment in an articles series on STOXX’s annual investment conference held in London on March 30.

A panel at the `Innovate2Invest 2017’ conference was dedicated to ‘The Future of Factor Investing.’

Factor-based strategies are gaining traction, albeit at a very slow pace. At a first glance, they occupy only a small fraction of managed money. From October 2004 to January 2017, 92% of assets under management in European equities exchange-traded funds were allocated to standard market-cap strategies, compared with 0.05% invested in factor-based strategies. This happened despite the former posting an annual return of just over 6% in the period, compared with 14% for the latter1.

The return performance of these strategies is no ‘chance occurrence.’ Extensive portfolio-theory research2 has observed that equity returns can be explained by risk factors that are supplemental to the market risk. Investors who are able to expose themselves to such factors can obtain premium returns.

Aniket Das, investment strategist for index and smart beta at Legal & General Investment Management (LGIM), reviewed at `Innovate2Invest 2017’ the reasons why factor-based strategies are attracting more investor flows.

Das said factor-based investors fall into two camps: those invested in active management and who want to lower their governance and reduce costs; and those invested in market-cap indices who are looking to improve returns or reduce risk.

What both groups are seeking is “the middle ground that is factor-based investing,” said Das. “The middle ground between traditional active and traditional passive – and that’s speaking to the growth in the area.”

Diversification through factors

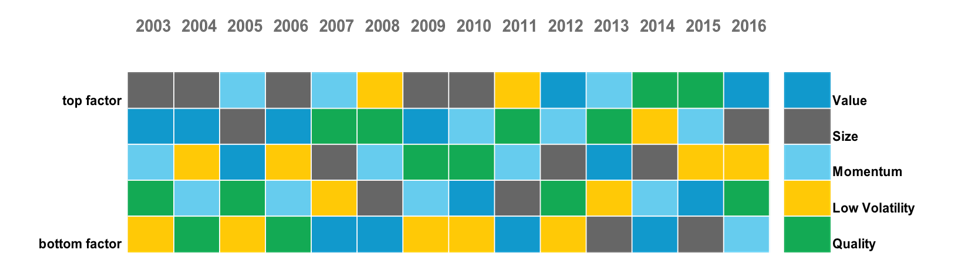

Das also discussed the appeal of multi-factor strategies as a source of diversification, by showing a chart of annual returns of five global factors (Figure 1).

Figure 1

Source: LGIM.

As LGIM’s chart shows, equity factor returns vary in time and do not follow a sequence. Therefore, an investor without a specific view on a given single factor and seeking diversification in returns, would be better served by following a multi-factor approach.

From indices with factor tilt to market neutral factor indices

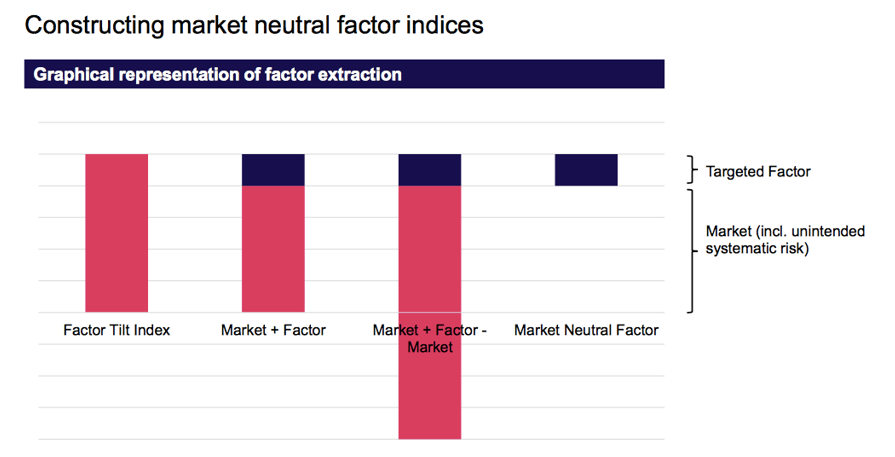

Das was joined on stage by Dr. Jan-Carl Plagge, head of applied research at STOXX. Dr. Plagge presented a next generation of factor-based indices that take one step further and isolate the market risk from the factor tilt.

“The outcome of factor investing is a tilted portfolio, but we still have the broad market exposure plus a targeted factor exposure,” Dr. Plagge said at the conference. “How can we extract the factor premia and get rid of the broader market exposure that we have always carried along?”

The iSTOXX® Europe Single Factor and Multi-Factor Market Neutral Indices thus give investors pure exposure to the factor dimension, and exclude unintended systematic risks.

The market-neutral indices are made up of a long investment in one of the six iSTOXX Europe Single Factor indices or in the Multi-Factor index, and offset the market exposure by holding a short position in STOXX® Europe 600 Index futures. Figure 2 exemplifies the indices’ exposure. To read about the iSTOXX® Europe Single and Multi-Factor Index families3, please see our “Factor Investing is Smart Investing” article.

Figure 2

Between July 2010 and December 2016, the iSTOXX® Europe Multi-Factor Market Neutral (total return) returned 55%, compared with 75% for the STOXX Europe 600 (gross return). Given that the Market Neutral Index was ‘short’ the market throughout the period, its performance is testament to the alpha generation capabilities of the factor sources.

In other words, the 55% return was obtained with zero market risk and more diversification than a long investment in the market.

Top-down vs. bottom-up approach

Das also described two ways of constructing a multi-factor based portfolio: a top-down approach (where the highest-ranking stocks by various factors are selected into an equally-weighted portfolio) and a bottom-up strategy (where each stock is given a multi-factor score and the highest-scoring stocks get into the portfolio). The top-down approach has a marked weakness in that by focusing on one factor per stock, it ignores their potentially low scores in other factors, he said.

STOXX has a bottom-up construction methodology that aims to maximize the aggregated exposure to all of the six factors rather than employ a mere heuristic, i.e. equal-weighted, combination of single-factor indices. Hence, the iSTOXX Europe Multi-Factor Index aims to include companies that score relatively well across the majority of the factors rather than those that score well in just one dimension but do badly in others.

An upcoming article on PULSE ONLINE will include a Q&A session with Dr. Plagge to develop on factor-based market-neutral strategies, with a particular focus on the benefits of low volatility and diversification.

Featured indices

iSTOXX® Europe Single Factor Indices

iSTOXX® Europe Multi-Factor Index

iSTOXX® Europe Single Factor and Multi-Factor Market Neutral Indices

Read about the conference’s other panels:

`Innovate2Invest 2017’ – The Complexity of ESG Integration

`Innovate2Invest 2017’ – No Doom Forecast by Nouriel Roubini, but Many Concerns About Trump

`Innovate2Invest 2017’ – From Punched Cards to Qualitative Measures: 50 Years of Altman’s Z-Score

1 STOXX data, net returns in euros.

2 For academic references on factor risk strategies, see “iSTOXX Europe Factor Indices – An Investable Access To Factor Risk Premia,” STOXX, Apr. 26, 2016.

3 Available factors are value, carry, momentum, size, low risk and quality.

4 For a complete methodology review of STOXX’s factor indices, please visit the latest iSTOXX Methodology Guide.