Opinion Leaders

Opinion Leaders

Dividend Strategies Tailored to Investors’ Needs

-

Dr. Jan-Carl Plagge, Head of Applied Research

Investors are increasingly fine-tuning their dividends approach by minding factors such as volatility and payout stability.

The very first income equity investors would focus on snapping up dividends from the highest-paying companies. This remains a valid and popular strategy that delivers what it says on the tin: income plays the predominant role in a portfolio’s returns.

As markets and prospects for returns evolved, however, specialized investors sought new ways to improve the performance of income strategies – and to avoid their inherent pitfalls too. From the initial focus on maximizing dividend yield, income strategies have progressed to approaches that add additional layers favoring stock quality and price stability.

This transition has been heightened by record-low yields in fixed-income markets, which have pushed income investors to the more volatile universe of stocks in search of dividends. Moreover, many are managers of pension-fund money pools with maturing liabilities as Baby Boomers retire. They can’t afford to stay in bonds if they are to meet retirement payments.

The changing patters of income strategies

In order to exemplify the progress in income strategies, let’s consider the following three approaches:

Maximum dividend – the ‘original’ or ‘elemental’ strategy, where the focus is on a high dividend relative to the share price. Companies are weighted according to their dividend yield.

Quality Dividend – the focus is on a high but also stable dividend yield. The strategy selects companies that have a history of paying and boosting dividends, hence avoiding ‘dividend traps’ that result from a drop in the underlying share price.

High dividend/low volatility – the focus is on high dividends and low underlying stock risk. Companies are selected based on dividend yield and stock-price volatility.

Building a dividend index that best suits investors’ needs

STOXX offers a broad range of strategies aiming at increasing the dividend yield, including the three described above. This means each approach can be implemented via a transparent and rules-based methodology.

The STOXX Global Maximum Dividend Indices exclusively focus on the highest forward-looking dividend yields. The STOXX Global Select Dividend Indices apply a quality filter to dividend payments. Finally, the STOXX Global Select Indices track companies with high dividend payments and low stock volatility.

For more information on methodology and calculation of all dividend indices, please click on the latest STOXX® Index Methodology Guide.

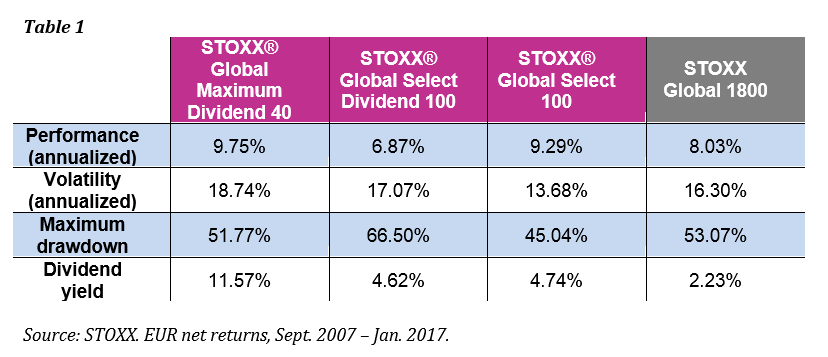

Table 1 displays the differing characteristics of all three strategies against the broad STOXX® Global 1800 Index.

Table 1 shows that while all three income approaches significantly increased the portfolio’s dividend yield, total return and volatility varies.

Price, yield and volatility

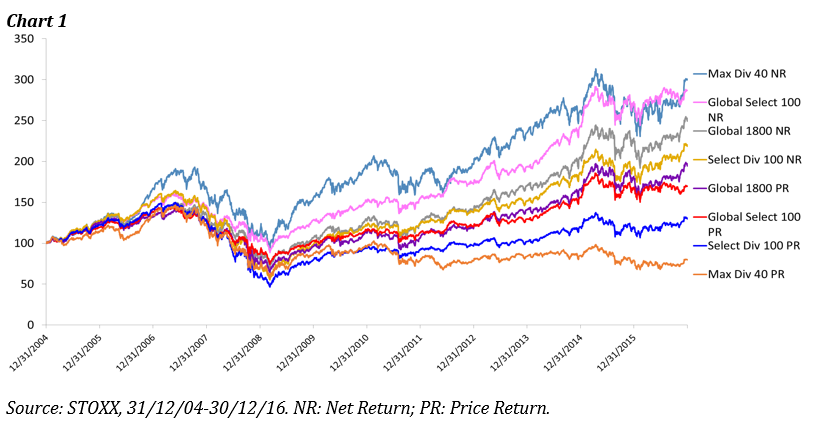

Maximum-dividend concepts yield the best long-term total returns, as they actively trade in and out of the highest-yielding shares at any given time. However, an exclusive focus on dividend yield comes at the price of reduced growth in the underlying stocks (price return) and higher variability in dividend yields over time.

For example, the STOXX Global Maximum Dividend 40 rose 200% including dividends between 2005 and 2016. Without them, it lost 20%.

On the other hand, focusing on the quality of dividends reduces the portfolio’s overall yield but boosts the long-term value of the underlying shares. In the same period, the STOXX Global Select Dividend 100 rose 119% when including dividends and 30% without them. It also saw a reduced yield fluctuation relative to the Maximum Dividend index.

The high dividend/low volatility composition generates dividend yields similar to the quality dividend approach, but it additionally profits from low volatility, contributing positively to price and gross performance. The STOXX Global Select 100 rose 187% between 2005 and 2016, and 70% excluding dividends.

Aiming at both high dividends and low stock-price fluctuations can deliver the best trade-off between risk, return and dividend yield. But it’s important to note that all income strategies can satisfy the diverse needs of different investors. From those who seek to extract the most value from dividends, to large asset owners who are happy to accept a smaller payout as a price to lower their portfolio volatility.

Selecting the right income approach is key for each investor’s mandate, style and horizon. When it comes to dividend strategies, one size does not fit all.

Featured indices

STOXX Global Maximum Dividend Indices

STOXX Global Select Dividend Indices

STOXX Global Select Indices

You want to receive our PULSE ONLINE mailing that updates you on new articles? Please send us an email to pulse@stoxx.com. You can share your feedback, comments or questions by sending an email to the same address.