Opinion Leaders

Opinion Leaders

Smart Beta ETF on ASEAN Region Arrives in Singapore

-

Shirley Low-Storchenegger, Head of Asia/Pacific

A new ETF on ASEAN-listed equities opens the way to tap into income and growth in the booming economies of Southeast Asia.

The STOXX® ASEAN Select Dividend 30 Index is gathering increasing investor interest as an intelligent and transparent income strategy to profit from one of the world’s fastest-growing regions.

The index tracks companies with high and sustainable dividend payouts from the six largest member states of the Association of Southeast Asian Nations (ASEAN): Indonesia, Malaysia, Philippines, Singapore, Vietnam and Thailand. The measure excludes companies with low tradability and poor dividend sustainability.

An exchange-traded fund tracking the index was listed today on the Singapore Stock Exchange. It is the first ETF in Singapore to follow a smart-beta strategy on ASEAN equities and is managed by Thailand’s One Asset Management.

A pillar of growth

ASEAN’s economic statistics speak for the momentum of a region that’s truly a pillar of Asian growth and that many consider to include the next generation of export tigers after the likes of Taiwan and Korea. At the same time, dividend investing has become an important source of yield in this low interest-rate environment. In particular for investors seeking growth and income to support their retirement needs.

The ASEAN countries grew 6% annually, on average, between 2010 and 2015, according to the Organisation for Economic Co-operation and Development (OECD)1. That’s about twice the rate for all nations under the OECD analysis. Studies2 show ASEAN would be the seventh-biggest economy in the world if it were one country.

As the fourth-largest exporting region in the world3, ASEAN has the potential to help offset a slowdown in the world’s emerging giant: China. The establishment of the ASEAN Economic Community (AEC) has set strategic direction towards forming a common market for goods, services, labor and capital. A deepening integration that will further improve the outlook for a region characterized by competitive costs and foreign investment.

Winning performance

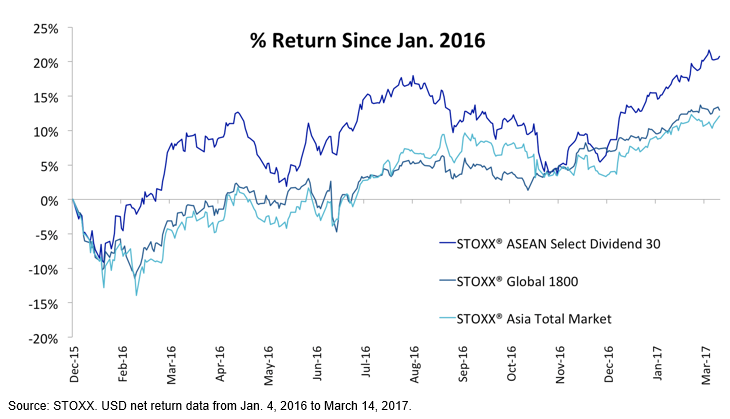

Investors have appraised the strength of this exports-driven region, with the ASEAN Select Dividend 30 Index gaining 21% since the start of 2016. The following chart shows the index’s performance against the broader Asian market and against a global equities strategy.

Index methodology

The ASEAN Select Dividend 30 Index ranks all equities in the STOXX universe domiciled in the six countries by their 12-month historical dividend yield. The top 30 stocks are selected with a maximum of seven companies per country (five for Thailand) but no minimum requirement. Real Estate Investment Trusts (REITs) are excluded from the selection, and components are weighted equally.

Investors have paid up to get dividend yield in recent years, both as so-called safe assets such as bonds offer little to no income, and because dividend stocks tend to be less volatile than the average equity. As many ASEAN companies become more established, they are evolving into sustainable dividend payers. The STOXX ASEAN Select Dividend 30 Index gives investors a route to benefit from that positive transition.

Smart beta expansion in Asia/Pacific

STOXX indices now underlie 12 exchange-traded products in six countries in the Asia/Pacific region, including its first vehicle introduced in Australia in July – a fund tracking the blue-chip EURO STOXX 50® Index. In March, we also licensed the iSTOXX® MUTB Asia/Pacific Quality Dividend 100 index to Yuanta Securities Investment Trust Company in Taiwan. The successful presence in this diverse region is likely to grow, as a booming economy and enthusiastic adoption of innovative products promises more indexing developments in months to come.

1 OECD Development Centre

2,3 “Understanding ASEAN: Seven things you need to know,” McKinsey, May 2014